En cours de chargement...

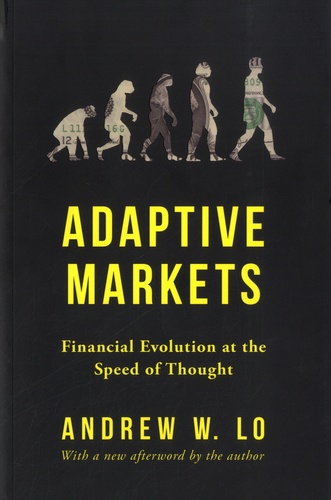

Half of all Americans have money in the stock market, yet economists caser agree on whether investors and markets are rational and efficient, as modern financial theory assumes, or irrational and inefficient, as behavioral economists believe. The debate is one of the biggest in economics, and the value or futility of investment management and financial regulation hangs on the answer. In this groundbreaking book, Andrew Lo transforms the debate with a powerful new framework in which rationality and irrationality coexist - the Adaptive Marken Hypothesis.

Drawing on psychology, evolutionary biology, neuroscience, artificial intelligence, and other fields, Adaptive Markets shows that the theory of marker efficiency is incomplete. When markets are unstable, investors react instinctively, creating inefficiencies for others to exploit. Los new paradigm explains how financial evolution shapes behavior and markers at the speed of thought - a fact revealed by swings between stability and crisis, profit and loss, and innovation and regulation.

An ambitious new answer to fundamental questions about economics and investing, Adaptive Markets is essential reading for anyone who wants to understand how markers really work.